The Hidden Cost of Battery Degradation: Why OEMs Pay Millions to Find Out Too Late

Degradation isn’t a technical problem. It’s a programme risk.

For most automotive OEMs, durability testing is treated as a necessary engineering cost. It happens in the background, scales quietly, and is rarely questioned until something goes wrong.

But when you look closely at how battery programmes actually run, degradation reveals itself as something else entirely: a silent drain on programme margin, time-to-market, and decision confidence.

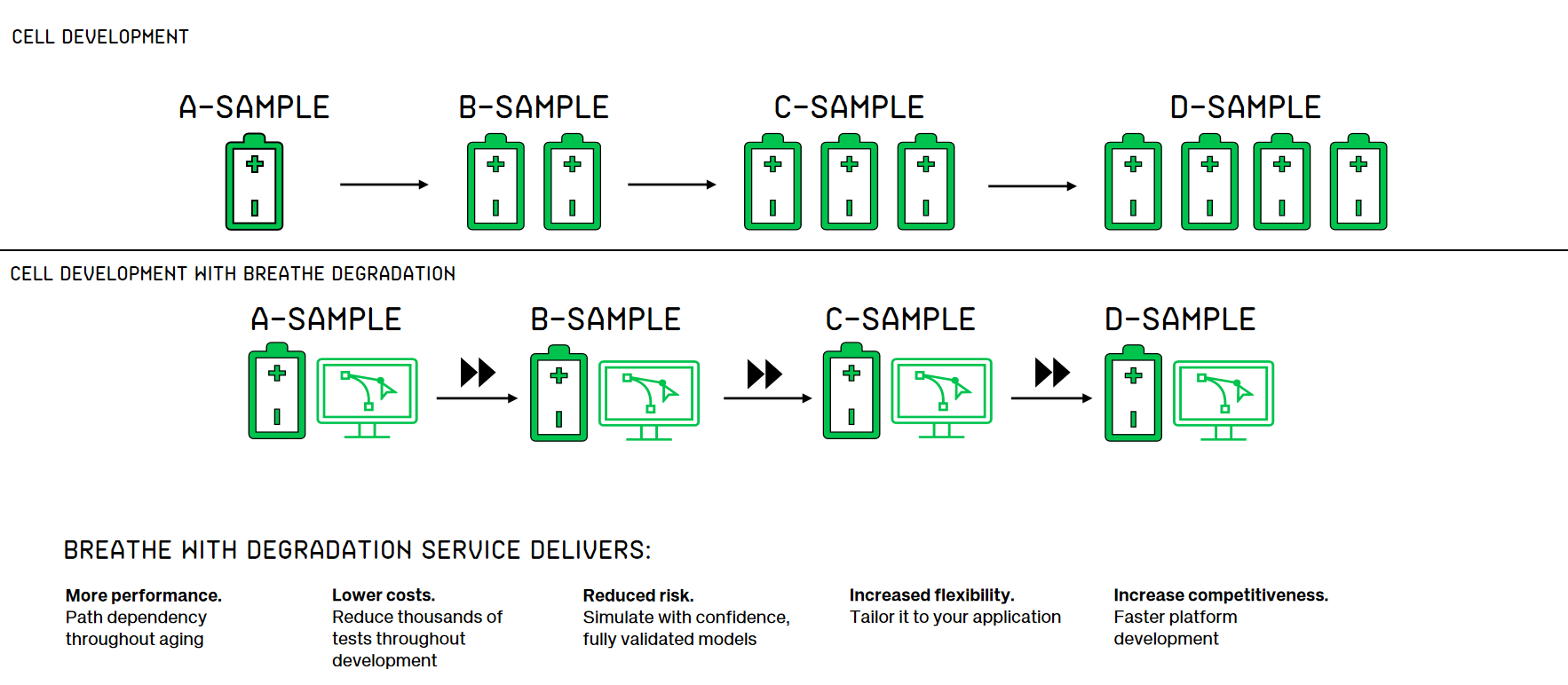

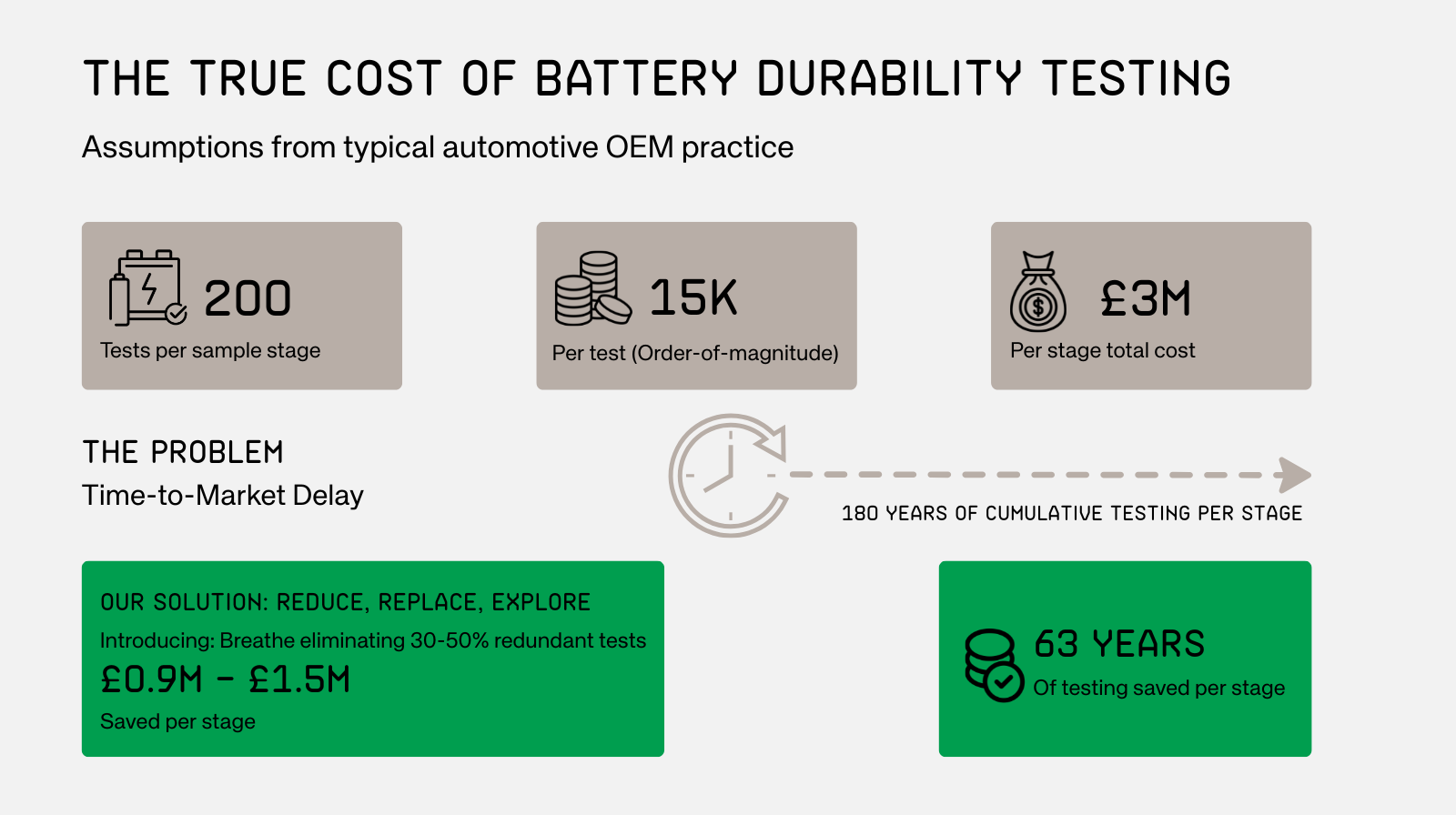

In a typical cell development programme, degradation testing alone can cost ~£3m per sample stage, before platform multipliers are even considered. Across A–D sample phases, that cost compounds, while flexibility steadily disappears.

By the time degradation risks are fully understood, the programme is often already locked.

As cell programmes progress, testing cost and risk increase while flexibility disappears.

Why degradation becomes expensive late, not early

Cell development doesn’t fail because teams ignore degradation. It fails because they learn about it too late.

Early in a programme, OEMs have room to manoeuvre adjust chemistry, refine charging strategies, or rebalance thermal limits. Later on, every change carries outsized cost and risk.

The problem is that physical durability testing scales in the opposite direction:

More cells

More tests

Longer timelines

Higher energy and equipment costs

By C or D sample, testing has become a validation exercise, not a decision tool.

At that point, degradation is no longer an engineering variable. It becomes a business liability.

A programme owner’s problem, not just an engineering one

For programme owners and product leaders, the real KPI is not just cell performance. It is lifecycle value. How early can we make confident durability decisions? - How much physical testing is truly necessary? - What risks are we carrying forward simply because we couldn’t evaluate them earlier?

Every month spent waiting for long-duration tests is a month where capital is tied up and competitive advantage erodes.

A different approach: Reduce → Replace → Explore

Modern degradation modelling reframes durability from a bottleneck into a strategic lever:

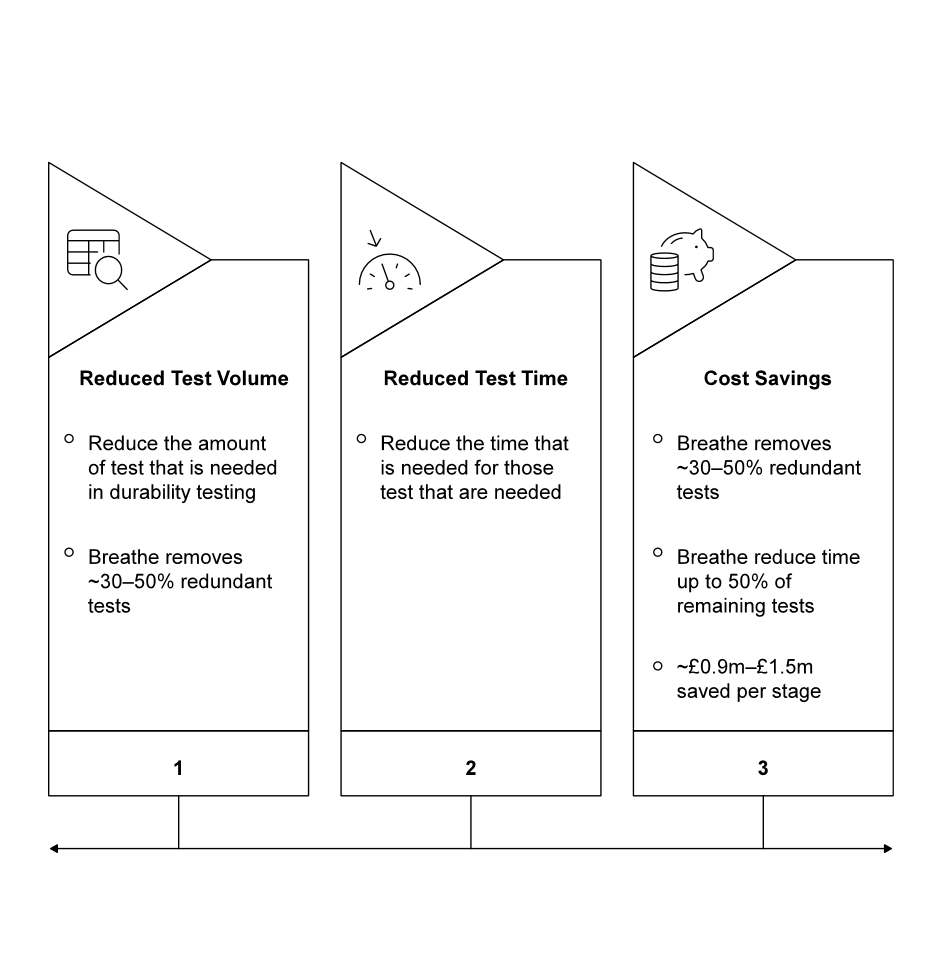

1. Reduce redundant ageing tests

OEM test matrices often contain 30–50% redundancy. Removing that waste immediately reduces cost and resource load, while preserving a held-out validation set for confidence and warranty evidence.

2. Replace them with validated degradation models

Physics-based degradation models are calibrated using a reduced but representative test set and validated against both external performance metrics and internal degradation states. This provides confidence beyond simple SOH curve fitting.

3. Explore lifetime behaviour early

Because the models are physics-based, thermally coupled, and capture full path dependency, teams can explore charging strategies, duty cycles, and edge-case usage scenarios from an informed degradation state. This allows durability trade-offs to be assessed earlier in the programme, rather than waiting for long-duration physical tests to complete. This exploration is intended to guide decisions and prioritisation, not to replace final physical validation.

The result isn’t fewer insights. It’s earlier confidence.

Reduced Test Volume →Reduced Test Time → Cost Savings

What this means in practice

Across a typical automotive programme, durability testing can accumulate to on the order of 180 years of total test time per sample stage, before platform multipliers are considered.

Against that baseline:

0.9m to £1.5m saved per sample stage

Approximately 63 years of cumulative testing time removed per stage

Durability decisions pulled forward by months rather than weeks

This isn’t about replacing testing entirely. It is about using physical testing where it matters most and avoiding it where it doesn’t.

Why this matters for platform competitiveness

Reducing durability testing cost and time is not just an internal efficiency gain. It directly affects the competitiveness of the vehicle platform itself.

When durability decisions are pulled forward, programmes carry less late-stage risk, timelines compress, and platforms reach SOP with greater confidence. That allows OEMs to bring vehicles to market faster, with lower development cost and tighter control over pricing and margin.

In other words, degradation insight does not just protect engineering teams from surprises. It improves the economics of the entire platform.

The real competitive advantage: decision timing

OEMs don’t win by knowing more at SOP. They win by knowing earlier.

When degradation is understood early, teams: - Reduce late-stage programme risk - Protect warranty margins - Move faster without sacrificing confidence

That’s not an engineering optimisation. It’s a business one.

How the degradation service supports real programme decisions

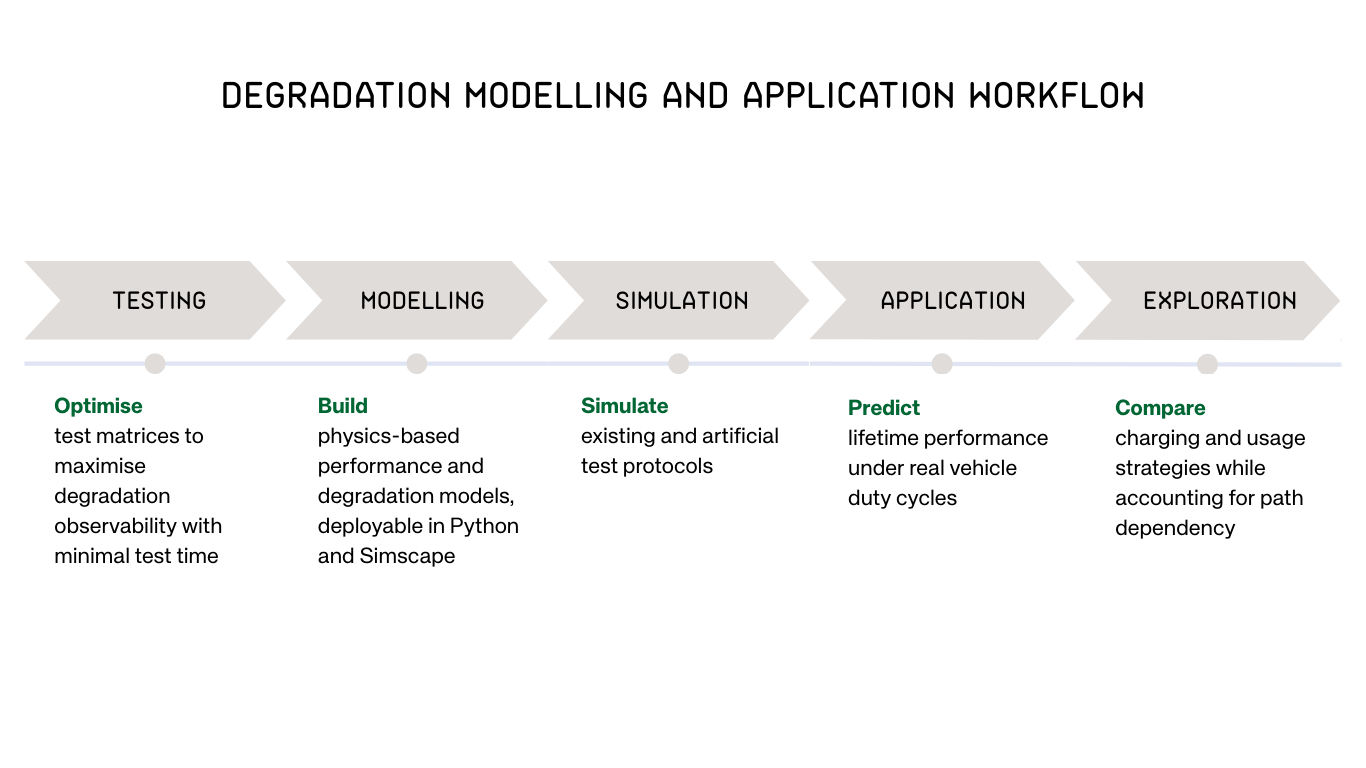

The degradation service is not a black-box data fit or an academic exercise. It is a physics-based approach designed to work alongside existing OEM durability testing and vehicle development workflows.

Breathe starts by optimising the existing durability test matrix, identifying redundancy while preserving a held-out validation set for warranty confidence. Based on this reduced but representative dataset, degradation models are calibrated and validated against real ageing behaviour.

Once validated, the models can be deployed in Python or SimScape environments and applied at vehicle level. This allows teams to predict performance metrics such as peak power, taper behaviour, and end of life performance, within their existing pack, thermal, and control models.

At a high level, the degradation service follows a structured workflow that integrates test optimisation, validated modelling, and early scenario exploration.

A simplified view of the degradation workflow, from test optimisation through model delivery to vehicle-level application and early “what-if” exploration.

Because the models capture path dependency, teams can explore real-world usage scenarios early, including different charging strategies and duty cycles, without waiting for long-duration physical tests to complete.

The goal is not to replace physical testing. It is to make durability insight available early enough to support confident programme decisions.

Next step: a degradation economics workshop

For OEMs exploring this approach, the starting point isn’t a demo.

It’s a focused workshop that maps:

Your current durability testing structure

Where redundancy exists

What decisions could realistically be pulled forward.

If you want to understand what degradation is costing your programme — and where the leverage sits, request a Degradation Economics Workshop in our Contact Form.